massachusetts estate tax table 2021

Revised February 2021. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Example - 5500000 Taxable Estate - Tax Calc.

. In 2022 Connecticut estate taxes will range from 116 to 12 with a. SPEAK WITH AN ATTORNEY TODAY. Ad Last Will testament Living Trust Health Care Proxy Power of Attorney Living Will.

The adjusted taxable estate used in determining the allowable credit for state death. 2021 Gift GST and Trusts Estates Income Tax Rates. The original news release from the IRS may be found here.

However the Massachusetts estate tax threshold is considerably lower. Massachusetts uses a graduated tax rate which ranges between. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Of all the states Connecticut has the highest exemption amount of 91 million. Any Massachusetts resident who has an estate valued at more than 1 million between property and adjusted taxable gifts is required to file a Massachusetts estate tax.

The graduated tax rates are capped at 16. Ad Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or.

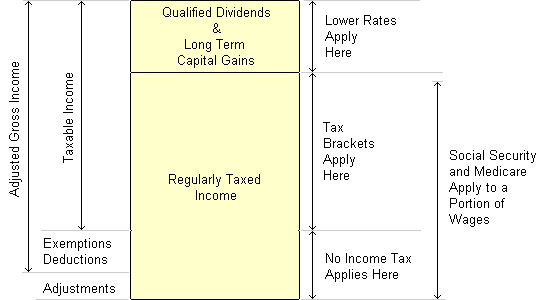

An estate valued at exactly 1 million will be taxed on 960000. In Massachusetts the estate tax rate is based on a historical federal credit for state death taxes. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Below is a summary of the 2021 figures. This is why residents whose estates hover around the 1 million mark have to be especially careful.

The estate tax rate is based on the value of the decedents entire taxable estate. Form M-706 Massachusetts Estate Tax Return and Instructions. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the.

They would apply to the tax return. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. A guide to estate taxes Mass Department of Revenue.

A local option for cities or towns. A state excise tax. Massachusetts Estate Tax Rates.

A state sales tax. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Massachusetts State Tax CalculatorWe. Ad Properly drafted estate plan does more than merely specifying what happens to your assets.

Federal estate tax law allows portability for the marital deduction which means that if one spouse doesnt use their 1158 million exemption the other spouse can use it. If your taxable estate including any taxable gifts made during your lifetime totals 1 million or more. Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively.

Instructions on page 9 updated Form M-NRA Massachusetts Nonresident Decedent. 402800 55200 5500000-504000046000012 Tax of 458000. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Up to 25 cash back If your estate owes estate tax how much will it actually owe. A married couple can effectively leave behind 234. Without planning your best intents to properly distribute your estate might not be enough.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The federal estate tax exemption also referred to as the estate tax exclusion is 117 million per person as of 2021. The filing threshold for 2022 is 12060000.

Massachusetts Estate Tax Everything You Need To Know Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

A Guide To Estate Taxes Mass Gov

How Is Tax Liability Calculated Common Tax Questions Answered

Massachusetts Income Tax H R Block

There S A Growing Interest In Wealth Taxes On The Super Rich

Massachusetts Estate Tax Everything You Need To Know Smartasset

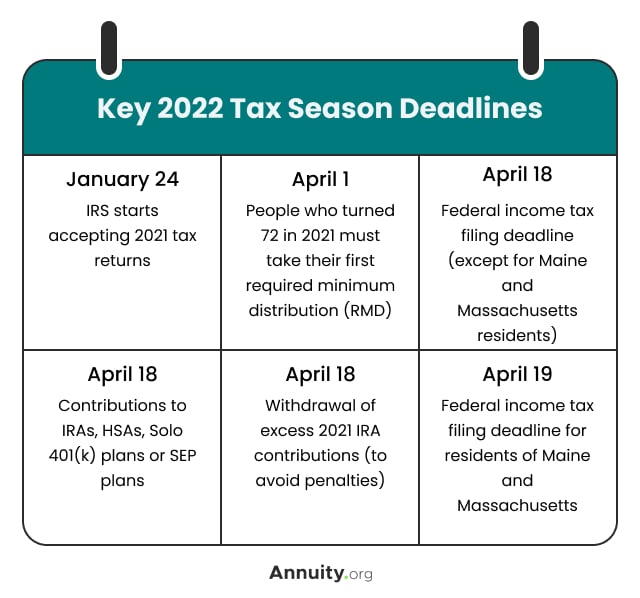

2022 Filing Taxes Guide Everything You Need To Know

Massachusetts Estate And Gift Taxes Explained Wealth Management

Massachusetts Estate Tax Everything You Need To Know Smartasset

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Massachusetts Income Tax Calculator Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Massachusetts State 2022 Taxes Forbes Advisor

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets Tax Foundation